In 2024, passive income opportunities continue to evolve, particularly in the realm of cryptocurrency. As the digital economy grows, crypto staking has emerged as a leading way for investors to earn consistent rewards without actively managing their assets. Among many sites offering such services, STAKING AI stands out with its innovative solutions, lucrative rewards, and smooth user experience. In this article, we’ll take a look at the top 5 passive income ideas in 2024, and see how STAKING AI lets users increase their earnings by staking their digital assets.

Key Takeaways:

- STAKING AI offers unique staking plans with high rewards, making it an ideal platform for those looking to generate passive income through cryptocurrency.

- The platform provides a free $100 staking bonus upon signup, alongside referral rewards for recommending friends.

- Investors can benefit from STAKING AI’s 24/7 client support, high-quality blockchain infrastructure, and global coverage.

1. Staking on STAKING AI

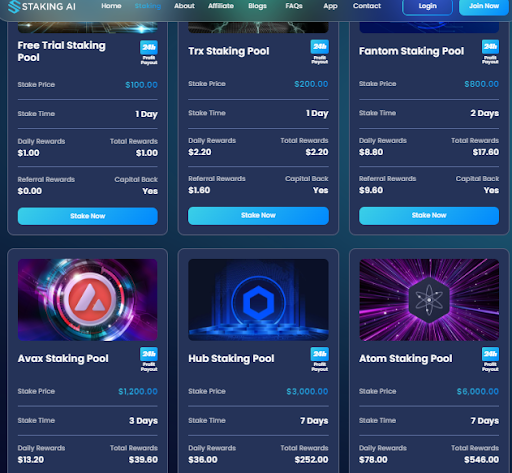

Of all the great passive income ideas in 2024, cryptocurrency staking is undoubtedly one of them, and in the frontline is STAKING AI. By locking your digital assets with STAKING AI, you can enjoy consistent rewards without having to run validator nodes. STAKING AI offers customized staking plans to meet every investor’s needs, whether short-term options or longer commitments offering higher returns.

For example, the free trial staking pool will give you $1 daily for staking $100 for a day with no lock-up period and at limited risk. If you’re willing to commit more, there are more lucrative options, like the SOL staking pool, where you can stake $150,000 for 30 days and earn $3,750 daily, plus $6,900 referral rewards.

How to Get Started on STAKING AI

To start earning passive income on STAKING AI, simply follow these easy steps:

Easy Sign-Up: Sign up with your email, username, and referral code if you have one for more benefits.

Select a Staking Plan: Select a staking plan that fits in your budget and time frame. They have staking plans from one day to several weeks.

Earn Rewards: Once staked, rewards are settled daily into your account. You can view and withdraw these rewards anytime.

In addition to that, the STAKING AI application will make it easier than ever to track your performance and rewards on the go. With point-and-click staking, you can operate your portfolio right from your smartphone.

2. Staking Affiliate Programs

Affiliate programs offer another stream of passive income. For example, one can earn some commission by referring new users to stake on the STAKING AI platform. STAKING AI’s Affiliate Program is pretty interesting and assures 4% of commissions on the stake amount of the referred users. There is no cap on the amount one can make, unlike in other programs, making this very lucrative for influencers, bloggers, or anyone with a digital presence.

Other exciting features include lifetime commissions. Once a referral starts creating stakes on the platform, you keep earning from their activity without an end to that. This creates a continuous income stream with minimal effort.

3. Liquid Staking for Increased Flexibility

For investors who want to retain liquidity over their staked assets, liquid staking is a game changer. Normally, in staking the staked assets get locked for a certain time, but in liquid staking, users receive synthetic tokens that represent their staked assets, which, in turn, can be utilized in DeFi protocols for extra earnings.

STAKING AI partners with leading liquid staking providers to let users max out the passive income of their holdings. With the STAKING AI platform, users can stake their assets but still have FULL custody and access to those assets for trading, lending, or borrowing against. It is the best of both worlds; enjoy staking rewards while keeping your assets liquid.

4. Yield Farming

Another lucrative passive income is yield farming, where investors make rewards by providing liquidity to different decentralized platforms. The thing is that yield farming usually requires big technical knowledge, but STAKING AI simplifies it for investors by giving the same opportunities in their user-friendly platform.

5. Long-Term Crypto Staking Plans

For those looking for higher returns over an extended period, STAKING AI offers long-term staking plans. Staking more substantial amounts, such as in the Ethereum Staking Pool Plus where staking $300,000 for 45 days earns $10,500 daily plus $15,000 in referral rewards, yields impressive rewards.

With STAKING AI, investors enjoy flexible terms after signing up, which allows them to choose a plan that best fits their financial goals. Its security infrastructure prioritizes the safety of all staked assets, making it the go-to option for those committed to building wealth in the long term.

Conclusion

STAKING AI offers investors a robust infrastructure, flexible staking plans, high daily returns, and a lucrative affiliate program to maximize their returns. STAKING AI also offers new investors a free $100 bonus to get them started after signing up. Stake now on STAKING AI and unlock your financial breakthrough.

Source: https://cryptodevrix.com/top-5-ways-to-earn-passive-income-through-cryptocurrency-in-2024/