Cryptocurrency staking is becoming a popular way to earn passive income in the crypto space. As investors look for the best platforms to get the most returns, you need to choose a crypto staking platform that combines high returns, security, and ease of use. In this post we will be looking at the top 5 staking platforms in 2024, each offering different opportunities for investors to earn up to $1,610 per month. We will also look into why CryptoBox is the preferred option for crypto staking enthusiasts.

Key Takeaways:

AI-powered strategies ensure you start earning rewards from day one.

Choose from short-term to long-term staking plans and get paid daily.

With a minimum investment of just $100, CryptoBox is for everyone.

What is Crypto Staking

Staking allows crypto holders to lock up their assets in a blockchain network to support its security and operations and earn rewards in return. The better the staking strategy and platform selected the higher the returns. With automated and AI-powered platforms, staking has become more accessible and profitable. Let’s now get started with the top staking platforms in 2024.

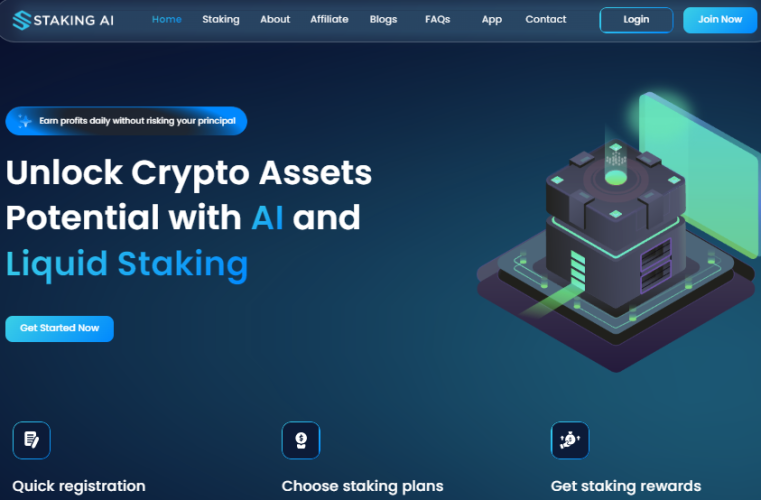

1. CryptoBox: Overall best Staking Platform

CryptoBox is number one for many reasons, starting with the $100 free staking bonus for new users. The platform is designed for everyone to be able to stake by lowering the entry barrier to staking. CryptoBox combines AI-powered automated trading strategies with liquidity staking to give you maximum returns and minimum risk on your stake. With CryptoBox you can start earning instantly as their platform provides real-time market analysis and automated staking plans for different risk levels.

Key Benefits of CryptoBox:

$100 free staking bonus just for signing up.

Referral commissions: 4% on your friend’s or referral stake when you refer them.

Million bounty programs: Earn up to $100 by doing social media sharing and promoting CryptoBox.

Secure staking: With advanced security protocols, 2FA, encryption, and McAfee-tested software, your assets are always safe from any threat.

Top-notch AI integration: CryptoBox’s AI system updates in real-time to market changes to give you maximum returns through automated trading.

CryptoBox also makes staking easy with its 3-step process: sign up, choose your plan, and start earning daily rewards. With a simple interface and 24/7 customer support, even a beginner can take advantage of staking with minimal effort.

2. Binance

As one of the biggest crypto exchanges Binance also has a staking option. Users can choose from many staking options including ETH staking and flexible DeFi staking products. Binance’s reputation for security and user-friendly interface makes it a top choice for both beginners and experienced investors.

3. Kraken

Kraken has built a reputation for itself by offering secure and simple staking services. With competitive interest rates and many supported assets, Kraken allows users to stake 20 different cryptocurrencies including Polkadot, Ethereum, and Cardano. Kraken’s transparency and staking guides make it easy to get started.

4. Crypto.com

Crypto.com is another top-staking platform for high rewards and many assets. It supports staking for major coins like Ethereum, and Cardano. The platform also has an easy-to-use interface and a mobile app for staking on the go. Crypto.com’s CRO staking also gives you extra benefits like higher returns and better trading fees on their exchange.

5. Coinbase

Coinbase is one of the easiest ways to get into crypto staking, especially for newbies. Although its staking options are limited compared to other platforms, Coinbase has a simple and secure platform where you can stake assets like Ethereum and Tezos with ease. However, the Returns may not be as high as other platforms but Coinbase is a well-known brand.

How to Get Started on CryptoBox

Getting started with CryptoBox is easy, all you need to do is:

Create an Account: Go to the CryptoBox website and sign up with your email, username, and strong password. Don’t forget to use a referral code if you have one to get extra earnings. You will also get a free $100 staking bonus after you sign up.

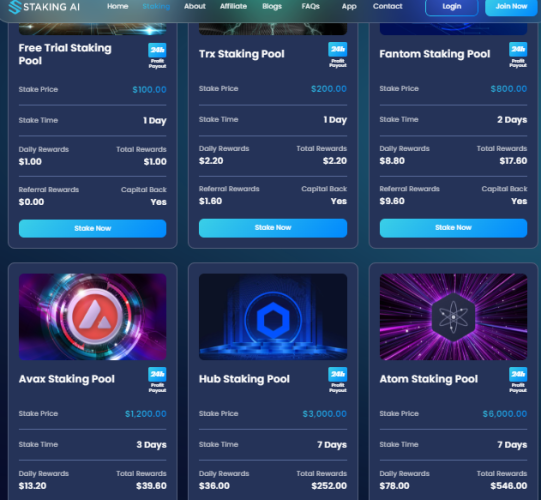

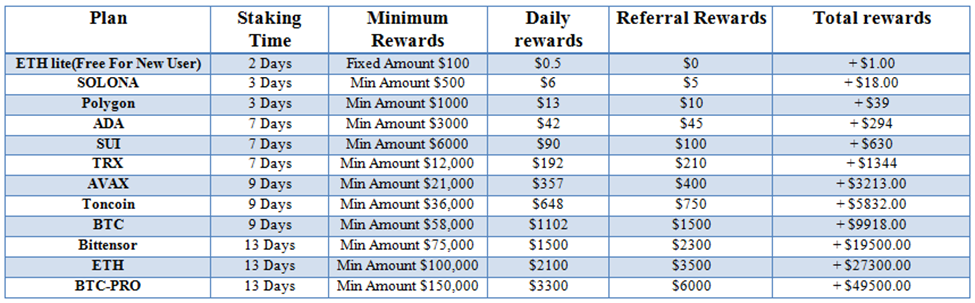

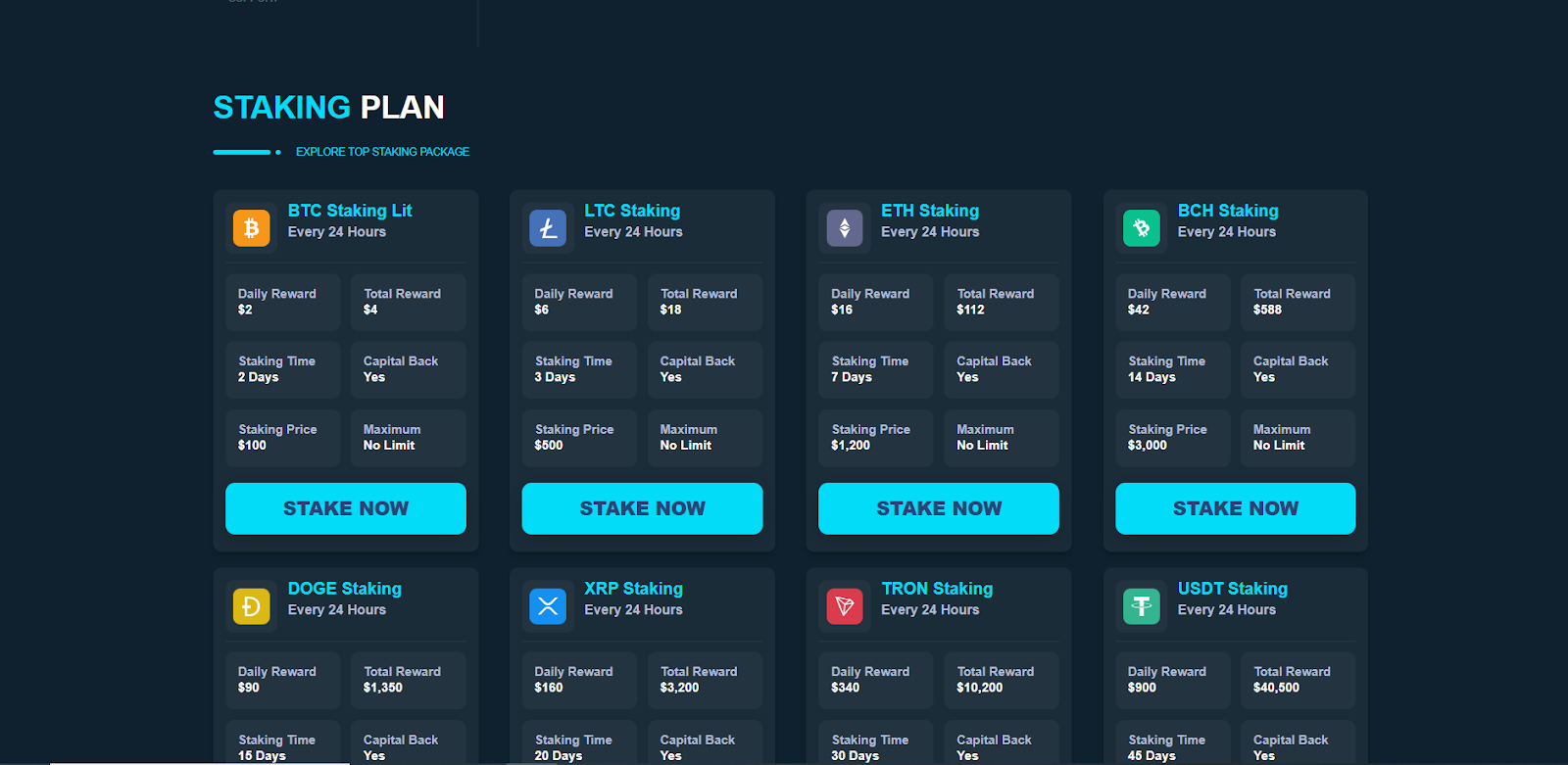

Choose a Staking Plan: CryptoBox has many staking plans for different investors’ budgets. You can start with as low as $100 and then try plans like Maker Staking, Filecoin Staking, or even Solana Staking. Each plan gives daily rewards and you can stake up to $300,000 to get maximum returns.

Start Earning: Once your plan is live you will start earning daily rewards. The platform’s AI will also optimize your staking strategy for maximum returns. You can withdraw your earnings anytime or re-invest to compound for higher returns.

Conclusion: Why CryptoBox for Staking?

CryptoBox has revolutionized staking with its AI automation, giving you ultimate convenience and high returns. Its secure platform, lucrative rewards, and flexible staking options make it the best for you to maximize your crypto earnings in 2024.

With up to $1,610/month in potential earnings, coupled with the free $100 staking bonus, referral commissions, and million bounty rewards, CryptoBox stands out as the best platform for both seasoned investors and beginners. Join CryptoBox today and start staking smarter!

Source: https://cryptodevrix.com/top-5-staking-platforms-in-2024-earn-up-to-1610-month/